Financial Crime

The fight against financial crime continues to evolve, and the stakes for financial institutions have never been higher.

Financial crime affects large global organisations but also the small companies and partnerships. Preventing and detecting Financial Crime is rapidly evolving to be one of their biggest challenges, the impact of which extends well beyond monetary losses to reputation and brand, employee morale, business relations, as well as regulatory censure.

The COVID-19 crisis provides a favourable environment for financial crime.

The Financial Action Task Force (FATF (2020b)) points to an increase in Money Laundering and Terrorist Financing risks stemming from COVID-19-related crime, which could include increased misuse of online financial services and virtual assets to move and conceal illicit funds as well as possible corruption connected with governmental stimulus funds or international financial assistance.

All central banks and banking supervisory agencies issuing public statements related to COVID-19 Money Laundering and Terrorist Financing threats have drawn attention to the evolving risks in the pandemic crisis and/or the heightened importance of continuing to fight these crimes and meeting AML/CFT requirements.

Authorities worldwide have responded with statements and by providing guidance to financial institutions, particularly on mitigating cyber-attacks and Money Laundering and Terrorist Financing risks. In both areas, authorities have highlighted the need for drawing attention to these crimes so that financial institutions and the general public are better informed; extra vigilance with respect to increasing and evolving risks; and active sharing of information between the public and private sectors, and within and between jurisdictions. The guidance issued underscores the trade-offs between expecting financial institutions to enhance or adjust their cyber resilience and AML frameworks and, on the other hand, avoiding imposing an excessive burden that could hinder financial institutions in delivering key financial services.

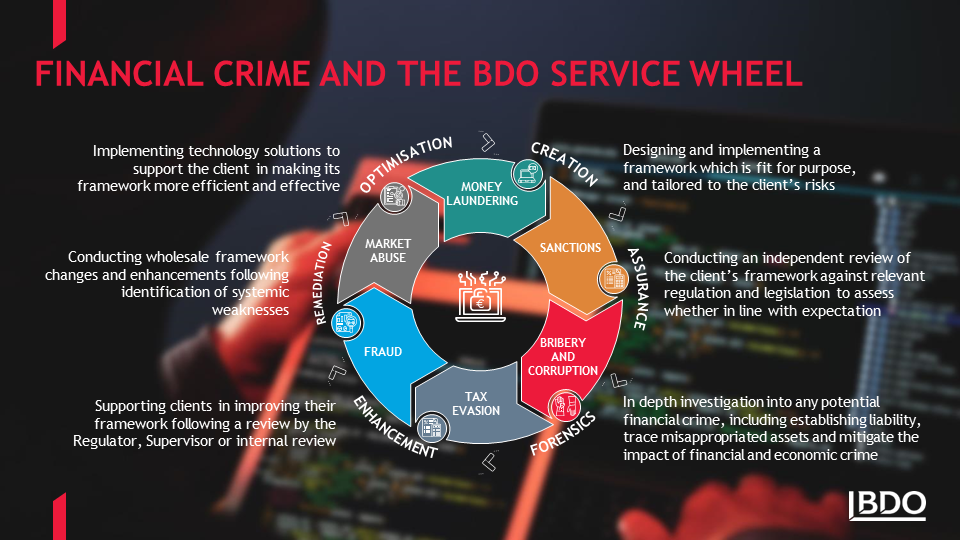

Our global BDO Financial Crime team offers advisory services and solutions to assist financial services firms in addressing financial crime-related threats and regulatory concerns. Please also see how BDO’s AML Compliance Tool, SILO Compliance System, can make AML compliance simpler, faster, and more comprehensive.