Five trends defining TMT companies’ reward and remuneration strategy

/Five-trends-defining-TMT-companies’-reward-and-rem/5trends-media-card.png.aspx?lang=en-GB)

Increased focus on ESG, productivity, and “doing more with less” are among the trends identified in BDO’s reward and remuneration survey covering the technology, media, and telecoms (TMT) industries.

Taking a look behind the curtain of ongoing layoffs in the TMT sectors shows a more complicated story taking place. As revealed in the BDO report Attitudes to Reward and Remuneration in TMT Companies, competition for talent remains fierce across the TMT industries.

Simultaneously, TMT companies are confronted by rapidly evolving business conditions that influence their reward and remuneration (R&R) strategies and initiatives.

Here we present five of the core dynamics and trends that influence companies reward and remuneration strategies.

Scarcity remains a driving factor

Massive layoffs by the likes of Meta, Amazon, and not least Twitter, have grabbed headlines over the last months. True to technology’s love of data, there is even a tracker keeping tabs on who has let workers go – and how many. The current total is over 130,000 employees that have been let go by 850 tech companies.

However, the numbers alone do not paint a full picture. There continues to be, intense competition for scarce skills. Areas such as AI, data, and cybersecurity are among those demanding salary premiums.

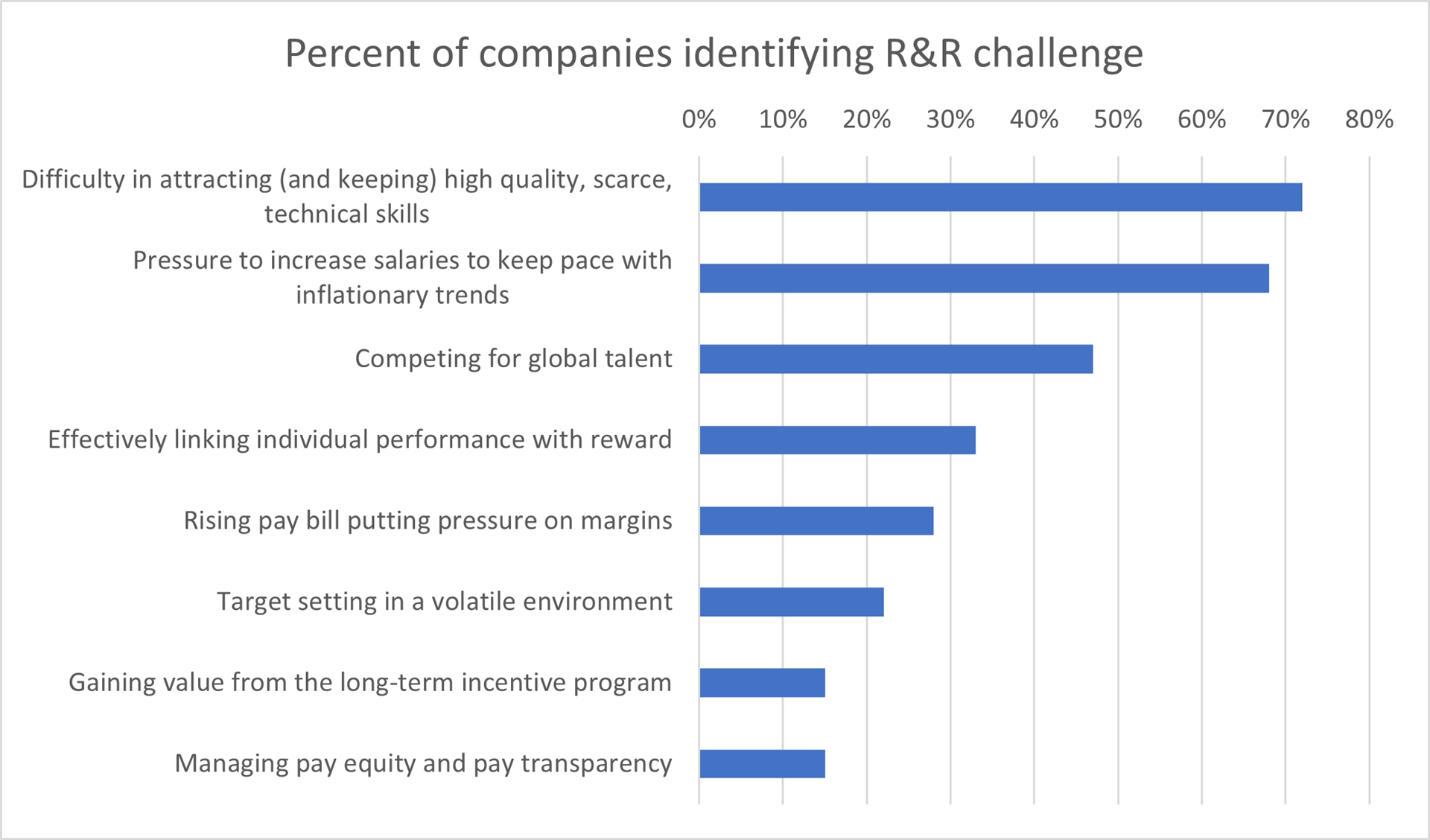

The situation is reflected in companies identifying the difficulty in attracting and retaining high-quality, scarce technical skills as their top rewards and remuneration

Source: ATTITUDES TO REWARD AND REMUNERATION IN TMT COMPANIES

That being said, macroeconomic factors such as increased inflation and market uncertainties are changing the impact of core R&R metrics, strategies, and initiatives for TMT companies.

For example, companies that have historically promised salary increases in line with cost of living are likely to find themselves in a difficult position as inflation soars. If global economies dip into recession, businesses will need to ask whether they can afford cost of living indexed salaries or need to pursue other strategies to attract and retain talent.

Productivity becomes key metric

Early in the onset of COVID 19, work from home became a reality across many companies and countries. Since, the TMT industries have been at the forefront of developing that strategy into “Work from anywhere – any way, and possibly even time.”

Flexibility has, in other words, moved beyond the home and office.

It is part of a broader shift across the TMT industries, where work itself has become more flexible, including in terms of place, hours, and timing. As a result, productivity and results are becoming even more central to both work KPIs and related reward and remuneration.

Furthermore, this can be seen in the openness that some companies (perhaps especially those unable to compete on salary where R&R is concerned) are embracing experiments such as four-day work week schemes, reduced hours in the summer, and working from other locations, including other countries.

All of the initiatives form part of a broader R&R strategy of accommodating core talent in order to retain them. It also presents companies with novel challenges.

For instance, enabling employees to work from different countries needs strong -in-house capabilities or collaborations with outside experts. Otherwise companies risk non-compliance with the differing rules and regulations, including tax and remuneration, that exist in and between different jurisdictions.

In this context, it is interesting that analysing people trends and acting on the outputs of such analysis remains less prevalent than one would expect given the data hungry profile of many tech businesses. More than half (56%) of companies taking part in the survey reported not having undertaken meaningful analysis of areas such as attrition rates, length of services, time to hire and recruitment activity– all of which would provide valuable insights for related R&R initiatives.

Mixing in-house and outside talent

In uncertain times, resilience is a core consideration to investment, often prioritised higher than initiatives to support scaling. The same dynamic applies to some of the moves that TMT companies are making around staffing and talent.

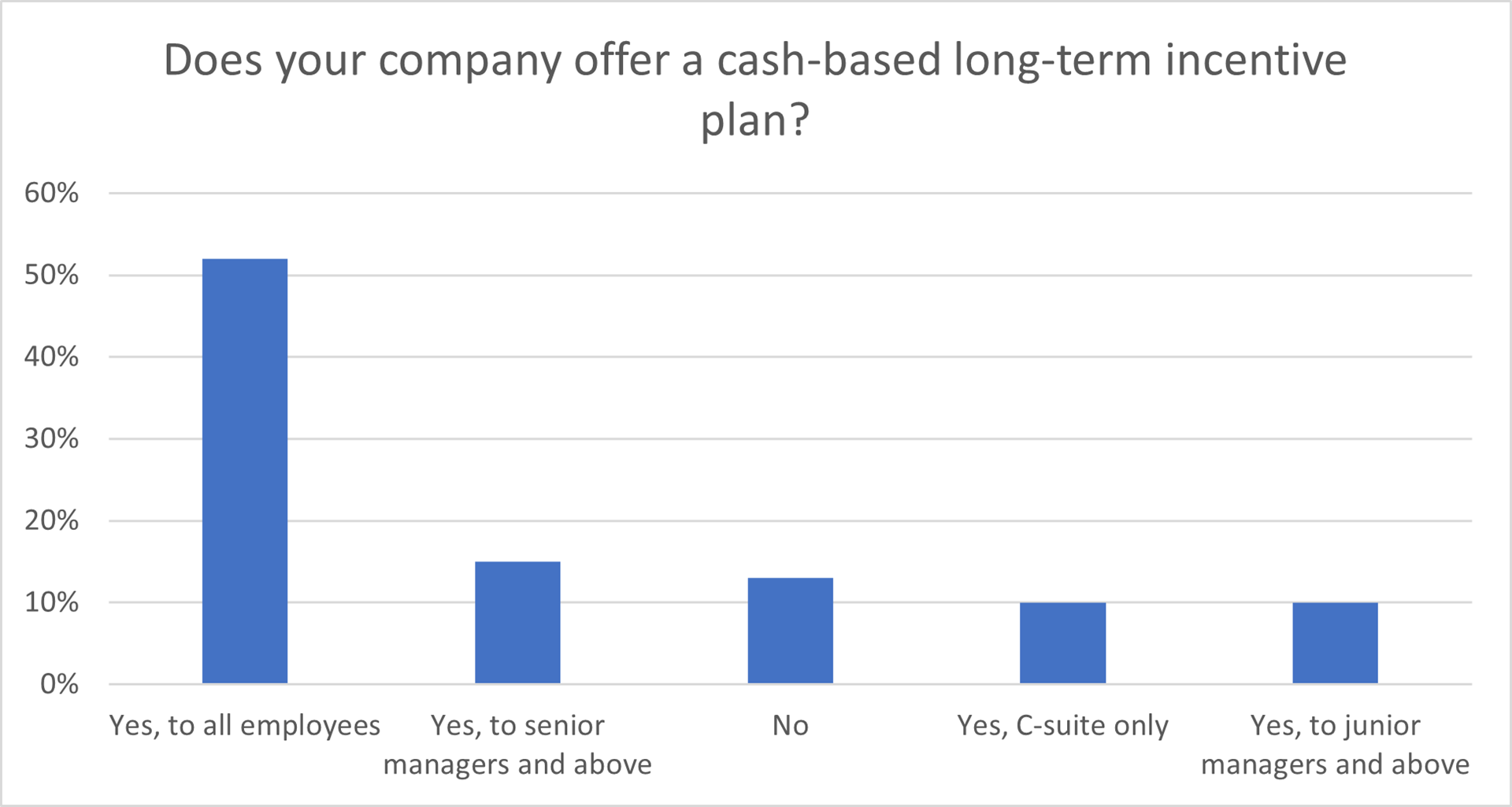

There seems to be an increased focus on “how to do more with less in-house.” This means that companies are more comfortable with fewer permanent staff and instead working more with third parties. Said in-house staff are often viewed as vital to operations. Meaning that pay and reward for such individuals includes participation in long term incentive plans that were previously reserved for only the most senior employees. For example, half of all surveyed companies offer cash-based long-term incentive plans to all employees.

Drivers for increased use of outside talent include the strong competition and uncertain economic outlook that encourages work models that lead to less fixed costs on the books.

As a result, TMT companies are pursuing more flexible resourcing and employment models, including contractors and freelancers. However, we expect contractors to see evolved offers that go beyond a day rate. For example, we can expect wellbeing offers that are traditionally reserved for full-time employees being extended to non-permanent employees.

Furthermore, the use of business services and outsourcing (BSO) to streamline areas such as financial and reporting functions, payroll, and tax by a trusted partner company is expected to become a growing trend.

Decreasing focus on equity

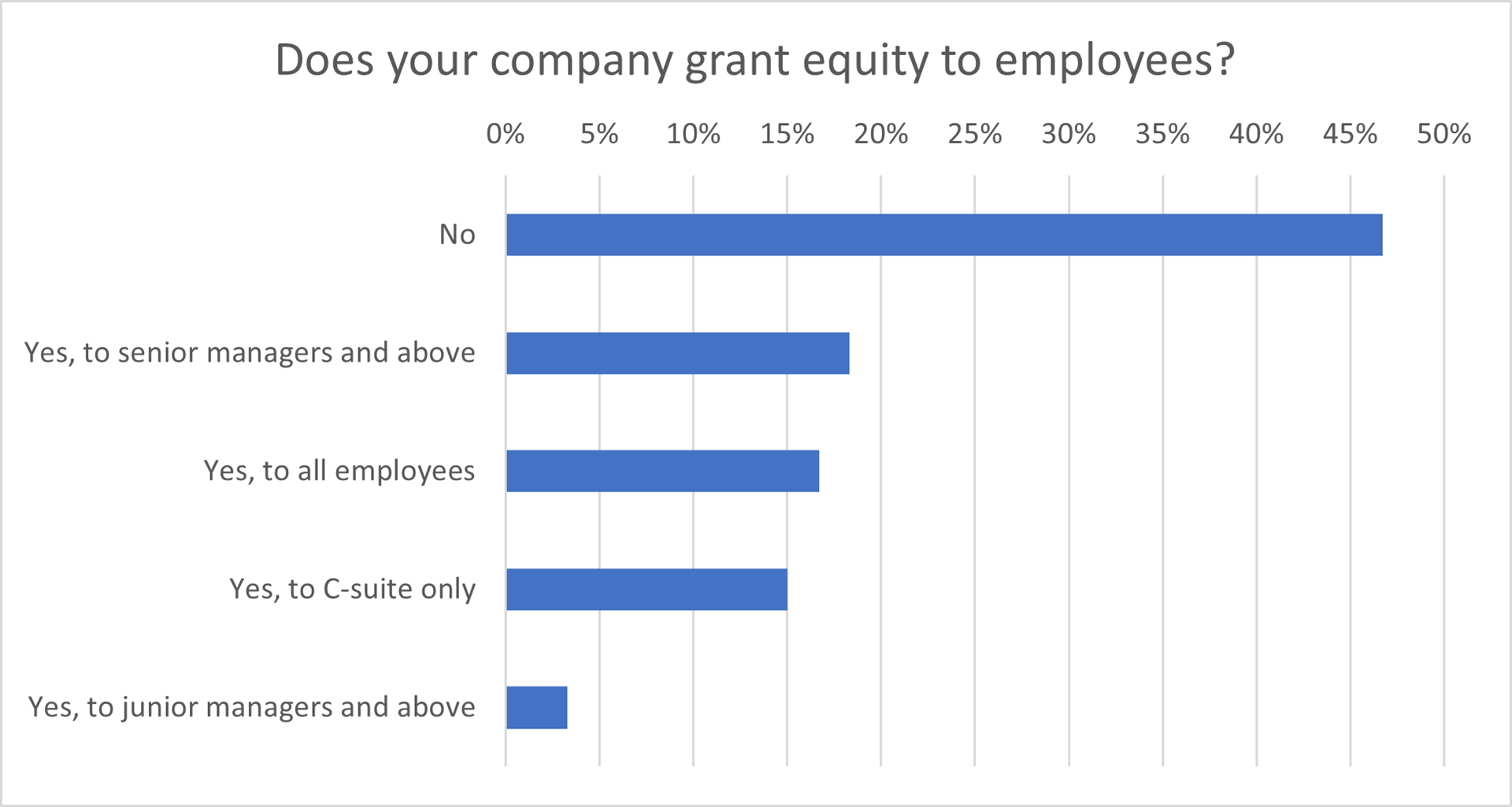

Equity has long been thought as a central reward and remuneration pillar in particularly the technology industry. However, the use of equity in R&R strategies seems to be dropping.

Just over half of the participating companies in the survey report that they offer some sort of equity.

When asked, companies say that talent attraction and retention are among the prime drivers for offering equity options.

The decreasing use of equity can be viewed as a direct result of increased market uncertainty. For employees, equity is dependent on a future event, such as the sale of the company or an IPO.

In uncertain times, the promise of cash tomorrow is not as strong an incentive to encourage staff to stay, particularly if greater salaries are offered elsewhere.

In terms of R&R strategies, we expect that cash will be king and long-term pay is fast becoming a luxury as the cost-of-living crisis bites. Programmes to trade bonusses for fixed pay or shifting annual programmes to quarterly, for example, may be some of initiatives launched by an increasing number of companies.

ESG and transparency increasingly important

ESG and sustainability are increasingly important for both employees and companies across industries. From an R&R perspective, having a strong track record in ESG and sustainability increases the ability to attract and retain talent.

However, the areas also raise new questions. For example, about how to include transparency and ESG in reward and remuneration strategies, as well as what it means for wider documentation across the company.

Among core areas to consider are pay transparency and good reward decisions, which can be evidence of the “S” (social) and “G” (governance) aspects of ESG.

We expect to see greater calls for transparency in pay and reward strategies around the world both from legislators and from organisations themselves that wish to ‘do the right thing’. Whilst legislative measures may not always provide the outcomes hoped for, that does not mean it has failed. It often starts a prolonged public discussion and raises awareness that would otherwise not exist.