Dramatic declines of the world’s stock exchanges as a result of the COVID-19 crisis

BDO Germany has carried out research into the effects of the COVID-19 crisis on the global stock exchanges. The global stock exchanges have been extremely affected by the COVID-19 crisis, with declines even larger and more rapid than the Financial Crisis in 2008. Compared with the indices at the end of February 2020, there have been losses of 30% to 40%. This development is the worst impact ever experienced historically speaking.

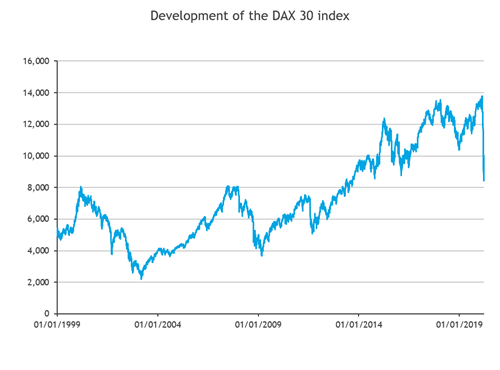

After a long period of a general upward trend, there is now a significant correction:

The German DAX 30 index fell by 38% to a level of 8,441.71 points, in a period of less than 4 weeks between February 21st and March 20th 2020. The index was last at that level in September 2013. The stock exchanges in other countries have seen similar falls. For example, the Dow Jones Industrial Index fell by 36%, the U.S. S&P 500 index fell by 33% and the MSCI world index also fell by 33%. Hartmut Paulus, head of Corporate Finace BDO Germany commented: “Compared with the terror attacks in September 2001, the Financial Crisis in 2008 and the debt crisis in 2011, it is clear that the fall in the stock markets as a result of the COVID-19 crisis is significantly worse“.

The next graph shows, for the German DAX 30 index, the fall as a result of the COVID-19 crisis, compared with the losses as a result of the terror attacks in September 2001, the Financial Crisis in 2008 and the debt crisis in 2011. The start of the current crisis has been set as month “nil“ and a relative index level of 100. The development of the index over a period of 52 weeks before this point, as well as for the subsequent 12 weeks is shown below.

/Dramatic-declines-of-the-world’s-stock-exchanges-a/DAX-11.png.aspx?lang=en-GB)

The same analysis shows that for the Dow Jones Industrial Average index, the current declines are also significantly worse than they were during other recent crises.

/Dramatic-declines-of-the-world’s-stock-exchanges-a/DAX-12.png.aspx?lang=en-GB)

“The significant declines in the stock exchanges reflect a combination of reduction in activities for companies, the draconian measures taken by many governments limiting public life and economy activity, the uncertainty over the further development of the COVID-19 crisis as well as a general increase in uncertainty“, according to Hartmut Paulus.

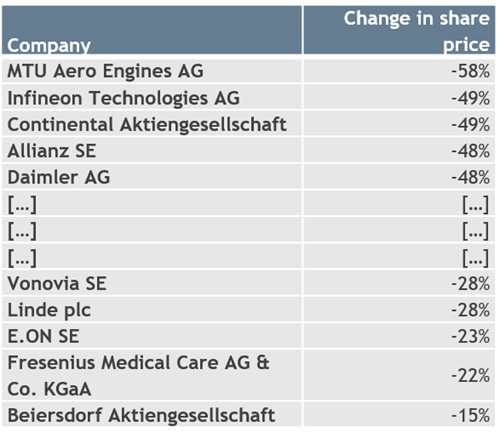

The impact, for specific companies, has been very varied. Companies in sectors such as airways, tourism and the car industry have shown losses of 50% or more. Consumer goods, care companies, as well as telecommunications and IT companies on the other hand, have shown lesser losses.

The shares of companies which were already in a tougher economic postion, have also shown a more significant loss.

The next graph shows the companies with the 5 biggest and lowest falls in share price in the period from February 21st to March 20th 2020

Time will tell whether the falls on the stock exchange to date reflect the full impact of the expected negative impact on the economic activity of the companies, or whether there is an element of over-reaction. Recently the markets have stabilized somewhat compared to the earlier dramatic declines. The major stimulus packages by all major countries has played a role in this. However, it is clear that it is too early to make any solid predictions on the further development of the COVID-19 crisis, nor the political, economic and societal impacts.