10 Due Diligence Challenges For Battery Energy Storage You Might Not Know About

Let us start with the good news: the price of battery energy storage systems is dropping rapidly – a trend that looks set to continue for years to come. The lower prices herald sweeping changes to how and where energy is produced, enabling integration of more renewable energy into an increasingly distributed and flexible energy grid.

Let us start with the good news: the price of battery energy storage systems is dropping rapidly – a trend that looks set to continue for years to come. The lower prices herald sweeping changes to how and where energy is produced, enabling integration of more renewable energy into an increasingly distributed and flexible energy grid.

However, challenges and bottlenecks also arise as battery storage continues to grow in popularity. They must be met if battery energy storage, and by extension renewable energy production, is to reach its maximum potential – both in deployment and for investors’ returns.

BDO Natural Resources teams around the world advise clients on renewable energy and energy storage investments. In this article, I seek to present some of the, at times hard to spot, due diligence challenges that our clients face in the space.

I believe it can serve as a starting point for further conversations about energy storage and the future of energy production. I hope that it will inspire feedback from readers working in the renewable energy space and beyond.

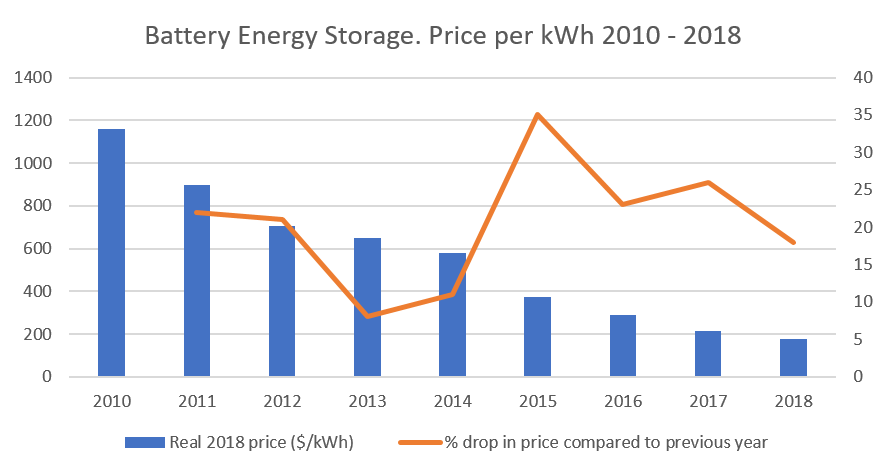

Prices keep falling

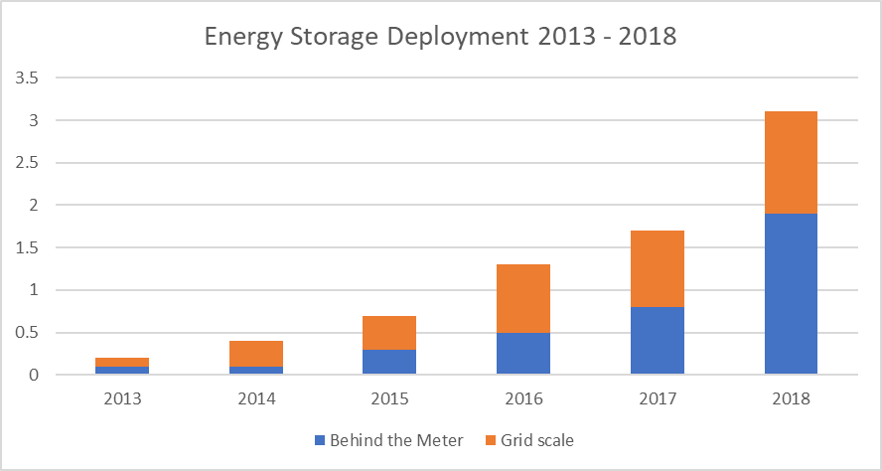

The continued drop in prices for battery energy storage is contributing to the spread of energy storage.

Data: IEA, Graph: BDO Global

While stored hydro remains the main technology for energy storage (more than 90% of installed energy storage capacity is hydro storage), data clearly illustrates that batteries are leading the way amongst other technologies.

Data: IEF, Graph: BDO Global

Data: IEF, Graph: BDO Global

According to the latest figures from the International Energy Agency (IEA), lithium-ion batteries currently make up nearly 85% of installed new capacity.

Investment is also booming, with Bloomberg New Energy (BNEF) describing energy storage as a ‘$620 billion investment opportunity.’ The prediction is heavily dependent on the upfront cost price of lithium-ion batteries dropping to half by 2030. According to Utility Dive’s analysis of the figures, we will see global battery energy storage deployments worth $1.2 trillion by 2040.

Navigant Research has charted almost 2,100 ongoing energy storage projects globally, with storage markets likely to grow exponentially over the next decade. Changing rate structures, electric vehicles, solar PV integration, need for more resiliency/backup power, and new business models are amongst the prime growth drivers. For all of these areas, battery storage is set to play a pivotal role – doubly so for electric vehicles and solar PV integration.

The investment conundrum

With so much good news, it may be counterintuitive that due diligence challenges either already affect or loom on the horizon for battery energy storage. However, that is the case. Some are tied to the impact of the further spread of energy storage systems, such as scarcity of materials. Others stem directly from energy storage’s explosive growth, including stresses and challenges to existing grid infrastructure, while others again are tied to the need for updating existing legislation to support the rapid growth of energy storage.

1: Are renewables stalling?

There could be a future drop in the deployment of energy + storage solutions, as renewable energy investments have been slowing. Data from the IEA showed that global investment in renewables fell by 7% in 2017, the largest drop in over 15 years. While investments stabilised in 2018, the trend has wider consequences that will spread to energy storage, unless reversed.

Furthermore, investors are dealing with the rhetorical question of why they should invest today if the same investment will get you more bang for your buck next year.

Data: Bloomberg New Energy Finance, Graph: BDO Global

2: Unpredictable technology surges

Almost everyone believes that energy production is going to transition from coal and gas towards renewables over the coming 20 years. That makes the need for more energy storage unavoidable. The question becomes, if you will forgive the play on words, whether the current technology is going to be the preferred technology in 20 years’ time. It is one aspect of accurately calculating ROI scenarios. Investors need a keen understanding of the developments and keeping track of potentially disruptive technologies is a must.

Thorough due diligence ahead of each investment, as well as sparring with industry insiders and experts, should provide investors with the optimal foundation for making decisions on what battery storage technologies to back.

3: Supply worries

Lithium-ion batteries rule as king when it comes to energy storage battery systems. They are also the preferred solutions for powering emerging technologies like electric cars. A potential knock-on effect could be rising prices for materials in high demand and shortages, for example, of cobalt, which could lead to higher battery storage prices.

Furthermore, access to critical materials may be hampered. China is by far the largest producer of cobalt, and the ongoing trade war between China and the US could lead to production pipeline issues. Finally, China’s growing internal market could also hamper exports, leading to higher prices.

All of which has put pressure on large producers of batteries, including the likes of Tesla who recently expressed concerns about potential future mineral and metal shortages.

4: Regulatory uncertainties

One of the biggest challenges to the further development of renewable energy and energy storage has little to do with the materials or technologies themselves. It has to do with regulatory frameworks. In many places, regulators are playing a game of catchup.

An illustration of this is the European Union’s Electricity Directive, which just ten years ago had no mention of storage at all. As a result, unclarity has dogged areas such as whether transport tariffs would apply to the use of storage if electric vehicles become a widespread part of the energy grid (the directive was updated earlier this year).

Across the pond, changing regulations are also causing uncertainty. For example, regarding how grid operators will implement the Federal Energy Regulatory Commission (FERC) Order 841, which outlines how utilities should create market mechanisms to accommodate batteries’ two-way[MR3] (charge and discharge) capabilities.

5: Looming inertia issues?

One of the areas which could give rise to further regulatory changes is grid inertia. Broadly speaking, an energy grid depends on having a pool of energy available to counterbalance sudden variations in production and use. Without it, the grid could experience blackouts.

The intermittent nature of renewable energy production could create issues as energy production moves away from fossil fuels. A blackout which struck the UK grid in August 2019 was partly due to a large wind farm unexpectedly going offline. The situation demonstrated that battery storage will have an important role to play in providing the grid with the fast response needed to offset such rapid drops in frequency. However, regulators may be worried about the intermittent nature of renewable energy production and still limited capacity of energy storage systems (many deployed systems are meant to meet demand for shorter periods, such as four, eight or 12 hours). As a result, they may, in some territories, become tempted to issue temporary limits on how much battery energy storage can be integrated into a given grid.

6: Wider grid issues

Inertia is an illustration of a wider due diligence issue for battery storage: potential grid limitations. Due to its two-way nature, storage presents new challenges to existing energy infrastructure. The rhetorical question is, how to ensure that energy can flow both ways, from a multitude of sources, in the grid of the future?

Many different companies, including the more than 55 start-ups charted by CB Insights, are looking to provide answers to just that question. The lesson for this article is that any investment in energy storage should include a detailed analysis of the surrounding energy infrastructure systems, as well as emerging technologies.

7: No industry standards

As is often the case for early-stage markets, storage suffers from a lack of technical standards, as well as varying processes and policies.

For investors, this means that each project and its technical components present a unique endeavour with its own set of possibilities and challenges.

For example, when it comes to the batteries’ discharge, recharge and cycle times as well as the exact nature of connections to the surrounding grid. Furthermore, the introduction of new standards could also create disruptions in the market for battery energy storage solutions.

8: Dated market structures

Emerging technologies such as battery energy storage not only challenge regulatory policy. They also create issues regarding market structures. Wholesale market rules tend to be based on legacy infrastructure and technology. Even recent updates risk missing the mark when it comes to the structure and capabilities of most batteries.

In the US, one of the biggest issues surrounding the new FERC Order 841 rules is the requirement for storage batteries to have a 10-hour duration. This excludes much of the capacity already installed, as well as some of the most popular solutions currently available.

9: Is battery storage good for the environment?

The above may sound like an odd question. Of course, battery storage is good for the environment? It drives renewables, after all.

However, questions still surround how batteries are recycled after they are no longer used for storage. Manufacturers, resellers, recycling programmes, and electronics and vehicle recyclers can all be viewed as stakeholders. Agreements between all parties regarding the recycling and cost-bearing for said recycling can, at times, be unclear.

10: What does the bank say?

Many battery energy storage projects require large-scale investments financed through loans or taking on debt. To obtain the necessary capital through either approach, a company or investor must be able to present a granular financial model to third parties, such as banks or other financial institutions.

Such financial models should include risk analysis and resulting mitigation strategies covering subjects such as those presented above. By carrying out the necessary due diligence and including its results in the financial modelling, investors increase the ‘bankability’ of their proposals.

Is battery energy storage a good investment?

Whilst some of the points above may make it sound like investors should give battery energy storage a wide berth, this is far from the case. There are enormous upsides to investing in the space – which is also exemplified by the rising investment levels.

As noted during a recent energy roundtable held by BDO, combinations of renewable energy and storage are revolutionising energy consumption and production.

The goal here is to illustrate that as an emerging technology, much attention to detail and preparedness to delve into the granular detail of each project on a case-by-case level is necessary to make the most of an investment.

I hope that this article can be a starting point for a further discussion about the state of battery storage, its potential and especially the associated due diligence processes.