Now that €STR is here, what will happen to posted collateral?

Less than two weeks ago, the European Central Bank (ECB) published the euro short-term rate (€STR) for the first time. This marked a milestone for the ECB in the transition efforts on IBOR reform. Since the introduction of the euro, it is the first time that a crucial euro benchmark interest rate had to be replaced.

My hope is that institutions have readied their processes and systems for the change, and they can already begin to think about smoothing the next related transition: changes to interest rates that will impact posted collateral.

IBOR is being phased out around the world in the aftermath of a scandal that showed how easily it can be manipulated. It is being replaced by benchmark rates that will be calculated on the basis of actual trades and not a few traders’ estimates.

The benchmark is critical because it is the basis for so many other financial products, such as mortgages, corporate loans, government bonds, overnight lending and derivatives.

With the introduction of €STR, which reflects the wholesale euro unsecured overnight borrowing costs of banks located in the euro area, systems and settlement systems were impacted, and profit and loss statements will be impacted as well.

The rate was recommended in September 2018 by a private-sector working group. It was tasked with identifying and recommending risk-free rates that could serve as a basis for an alternative to current benchmarks, which are the euro overnight index average (EONIA) and the euro interbank offered rate (EURIBOR). The group recommended that €STR be used as the risk-free rate.

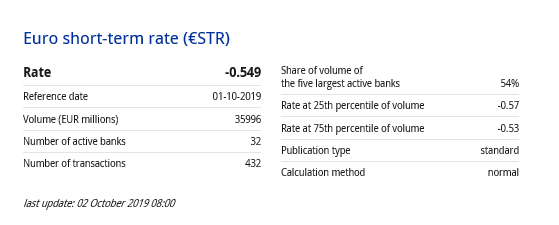

Before €STR’s first-time publication, the market was already aware of the change in basis points that the new rate would reflect: 8.5 basis points as determined by the ECB, due to a shift from an interbank lending rate to a wholesale borrowing rate.

Much has been written about what the rate change will mean for financial institutions and banks. In my opinion, the biggest and most immediate among the changes is the time it is published each day, which has implications on transactions, IT systems and processes at institutions using the rate.

The last time EONIA was published as such was at 7:00 p.m. on September 30, 2019, Central European Time; as of October 2, €STR was published in the morning on the “next” day, reflecting the rates for Oct 1. This means that in order to determine settlement amounts, financial institutions have to wait for €STR.

What I’d like to discuss now is how to smooth the transition regarding the collateral that financial institutions post to clearing houses on a daily basis. That transition will likely happen at the end of the first or second quarter 2020.

All collateral is interest-bearing on a daily basis, and €STR will be the interest-calculation mechanism. Since this is changing, institutions need to watch out.

The reason for a smooth transition is clear: If a financial institution posts collateral and then loses 8.5 basis points, then that financial institution and its shareholders will be unhappy about it.

Valuations of discounts

One way to respond is, of course, to minimize collateral postings because the interest they will earn will be less than before.

For that collateral that must be posted, we have articulated some suggestions.

For starters, companies should monitor how they are discounting swaps that are under collateral agreements, because discounting is dependent on how collateral is bearing interest.

For already existing collateral, there will be a cash payment equal to the net present value of this difference between EONIA and €STR.

But you lose 8.5 base points, not just in the collateral, but via the discounting. This could have a big impact on future profit and loss statements.

The central task for companies is to understand what this change will mean on the valuation of all a company’s derivative transactions.

For example, companies need to adjust their valuation engines for the derivatives, change the discount factor and run the valuation again through the engine with the new discount rate to see what the impact is.

In general, be aware of what kind of collateral your institution has posted with whom, understand that you will earn less money from €STR collateral in the future, and know that this will have a big impact on valuations because you will need to change this for the entire collateralized derivative portfolio.

Finally, companies need to consider what kind of second-order effect this might have on hedge accounting, funding policy and even more remote topics like equity futures which also contain EONIA.

I realize it’s a lot of to-do’s.

That’s why I bring it up now: Time is definitely running out for a smooth transition to new benchmark rates.